Philip

Morris International stock rose 4.2% on Thursday, July 21 just after Q2 2022

results were released. In this content, I will review PMI’s 2022 second quarter

results and I will share some key financials and more about their drivers to

make the numbers more meaningful. Since I am an employee of PMI, I prefer to

use “we”, “our” and “Emmanuel” (for our CFO Babeau) in some parts of the below content.

The data

used in this content are all publicly available and it does not include any

investing recommendation.

Q2 2022

results reflect the exceptional one-off events that have impacted PM this year,

notably the loss of earnings from Russia and Ukraine and the sharp appreciation

of the U.S. dollar. Excluding these, the underlying drivers behind PM’s

businesses have remained strong, and full-year 2022 outlook has been raised on

an organic basis.

Before the

highlights, we need to remember the announcement that PMI intends to exit the

Russian market in an orderly manner, as the complexities of continuing to

operate in Russia increase, such as supply chain challenges and financial and

banking sector restrictions.

PMI

demonstrated strong underlying momentum in the second quarter of 2022 with

another quarter of positive volume supporting better-than-expected growth. Most

impressive was the continued excellent IQOS performance and strong Q2 user

growth of more than 1.1 million, demonstrating further acceleration compared to

Q1 as device limitation and COVID restrictions continue to ease. This reflects

strong momentum in the EU region, Japan and developing markets.

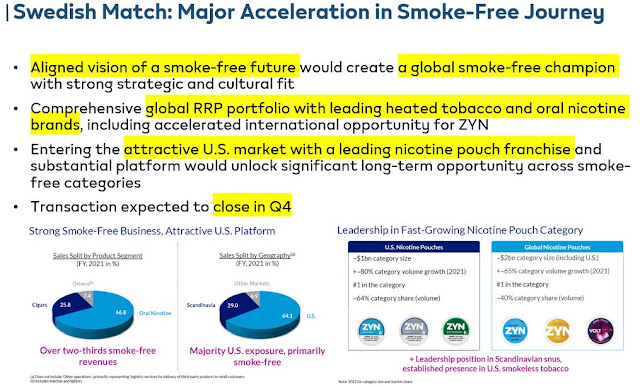

The proposed

addition of Swedish Match would further boost our future financial profile.

This is a value-creating offer for both sets of shareholders with a compelling

strategic and cultural fit, providing an additional opportunity to accelerate

our smoke-free future.

During Q2

2022, PMI had good volume growth and good currency-neutral revenue growth.

However, EBIT growth was weaker due to margin contraction and, including

currency, both revenues and EBIT fell year-on-year.

Volume

growth would have been stronger except for supply chain constraints, and the

margin contraction was also due to one-off factors.

Let’s dive deep into the stories behind these numbers and ratios.

In 2021,

Ukraine accounted for around 2% of PMI’s total cigarette and heated tobacco

unit shipment volume and under 2% of PMI’s total net revenues.

In 2021,

Russia made up almost 10% of total shipment volumes and around 6% of PMI net

revenues.

Despite the

impact of war in Ukraine, PMI increased its shipment volume by 1.1% compared to

previous year.

Net revenues

increased by 5.3% and this has mainly two drivers. The first one is the

continued strong growth of IQOS and the second one is ongoing recovery of the

combustible business. Here it is critical to keep in mind that the recovery is

realized against a pandemic-affected comparison.

When we look

at the revenue per unit, we see an increase by 4.1% in total. This increase is

especially important because this year there is a delayed timing of shipments,

as the company manages the cancellation of planned heated tobacco unit manufacturing

in Russia and company faces disruptions in global supply chains generally.

Our operating

income margin declined, and this reflected:

Firstly, the

investment to further expand and match the speed of PMI's smoke-free portfolio growth,

including the initial higher cost of ILUMA devices and heated tobacco

units, and the replenishment of distribution channels as device constraints ease

to support re-accelerating IQOS user growth;

Secondly,

the impact of supply chain extra costs, notably due to the war in Ukraine; and

Thirdly,

cost inflation driven by the global pandemic recovery and by the war in

Ukraine, notably for certain direct materials, wages, energy and transportation

costs.

Lastly, the

decline also reflected a challenging prior year comparison, which included

productivity savings.

When we look

at the assumptions for the next two quarters;

In the third

quarter, it is expected that IQOS and combustible volume trends will lead the

top line growth.

There are

some temporary headwinds which not only impacted PMI but also the whole World

and the expectation is that these will ease in third quarter.

And in the

last quarter of this year, HTU capacity problems will be better, so shipment

volumes for HTU will increase as well.

One of the

key updates in last quarter for PMI was its interest in Swedish Match.

Philip

Morris International is in takeover talks with Swedish Match over a

multibillion-dollar deal that would expand its smoke-free business.

In May, 2022,

Philip Morris Holland Holdings B.V. (PMHH), an affiliate of PMI, announced a

recommended public offer to the shareholders of Swedish Match to tender all

shares in Swedish Match to Philip Morris Holland Holdings at a price of almost

16 billion USD in cash.

This

alignment is strategic because it has the potential to create a global smoke

free champion with PMI’s leading heated tobacco and Swedish Match’s oral

nicotine brands. It will also open US market for PMI with nicotine pouch which

has long term opportunities for smoke free categories. But the deal is not

completed yet and PMI announces that the transaction is expected to close in

the last quarter of this year.

To sum

up:

Across H1 as

a whole, total shipment growth was strong.

IQOS’ growth

was helped by the new ILUMA device.

Combustible

products perform well to support smoke-free transformation.

PMI is

focused on its smoke free portfolio. IQOS will continue its dominance of the

Heat-Not-Burn ("HNB") category, to grow strongly in Europe and remain

at least stable in Japan. PMI has also launched its own e-vapor products since

2020 and has entered the nicotine pouch market with its own products on a

limited scale.

Management

comments reiterated their “unwavering” commitment to the dividend and hinted at

the possibility of increasing it with cashflows from Swedish Match after deal

close.

In

conclusion, PMI provides positive updates for its investors which make the

share prices increase.

Smart

investors and analysts are focused on how to earn returns and how to cash

out.

Investors

and analysts make decisions by asking critical Questions. That’s why I prefer

to give a special part for Q&A session from the Investors’ Meeting. The key

Questions are on IQOS new user momentum, Swedish Match acquisition, OI Margin

decrease, menthol ban in Heat Not Burn Products and reintroducing IQOS in the

US market.

The first

question is about the strong IQOS new user momentum.

According to

Emmanuel, our CFO, People realize all the benefits they can get by switching

from combustible cigarettes to the IQOS product.

Emmanuel also

states that we are enlarging the choice and that makes IQOS even more desirable

and attractive.

Additionally,

Emmanuel highlights that launching ILUMA is the second stage of the rocket in

the various countries to sell IQOS even higher, so it brings momentum. This can also easily be seen in the above graph.

The second

question is about Swedish Match transaction and other potential acquisitions.

Emmanuel

highlights that we continue to expect the closing of the transaction in Q4, of

course, subject to Swedish Match shareholder acceptance.

He also

mentions that the priority and the focus in terms of acquisitions is on Swedish

Match for the time being.

The third question

is about the decrease in the margins and its relationship with the higher costs of

ILUMA and HTUs and if this situation will continue or not.

Our CFO says

that inflation is one of the headwinds on the margin. Also, there are costs that

are coming from the disruption in the supply chain, notably coming from the war

in Ukraine.

Moreover,

there is a temporary acceleration of air freight charges. Emmanuel mentions

that We're not going to keep air shipping on the long term.

In

conclusion, inflation and other headwinds seen in Half One are temporary from

PMI perspective.

The fourth

question is about the full availability of devices when there is chip shortage.

Emmanuel states

that it is crucial for smokers to have Access to IQOS device in order to get

converted. He mentions that we see a rapid replacement of existing IQOS blade

device by IQOS ILUMA in the markets where ILUMA is launched. So, the main

objective is to equip the core consumer with new devices. According to

Emmanuel, this temporary shortage will finalize so its temporary impact on the

margin will be cleared.

The fifth

question is about the impact of the proposed elimination of menthol

variants in the EU for heat-not-burn products.

Emmanuel highlights

the facts that this plan needs to be approved by the Parliament and by the

European Council. Emmanuel reminds that it already has happened on a

combustible business with almost no impact or very limited impact. So, it isn't

clear that this will have a meaningful impact if it happens on our

heat-not-burn business.

The sixth

question is about the timing of reintroducing IQOS into the marketplace in the US.

For those

who are not aware of the latest IQOS situation in the US market, in November

2021, PM USA had to remove IQOS from the market due to an import ban and (cease-and-desist)

orders from the U.S. International Trade Commission (ITC). Altria, which runs

Philip Morris USA, announced it “does not expect to have access to IQOS

devices” in 2022, but “remains focused on returning IQOS to the market and is

working on re-entry plans.”

Emmanuel only

shares with the analysts that we expect to be in a position to introduce IQOS

in H1 of 2023.

The last

question is about Russia, mainly exporting IQOS devices to Russia and taking

cash out of Russia for dividend payments are questioned.

Our CFO

shares that there is no sanction for device export to Russia. Thus, although

there are some limitations coming from supply chain related problems,

exportation is not impacted.

For dividend

Payment, it is not exercised by PMI so Emmanuel could not provide an answer

about it. On the other hand, intercompany payments and royalties are paid

without any problem.

All these

announcements, investments and financials support PMI’s ambition to become a

majority smoke-free product company by 2025, building on its 2016 commitment to

a smoke-free future.